Settlink is a state-of-the-art service that simplifies your business' financial transactions.

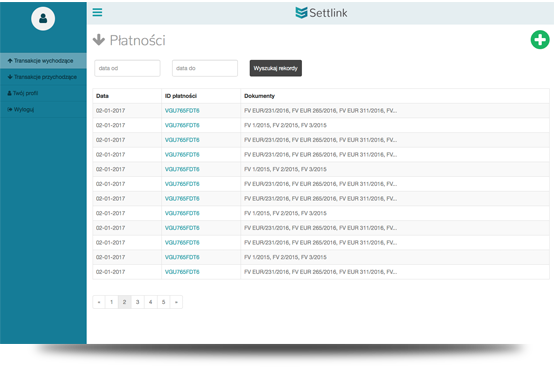

Payment processing is one of the key operations for every business. A comprehensive, well-organized summary of your transactions between suppliers and customers is crucial in ensuring that your business' finances are in order. It also assists in avoiding unnecessary problems during month-end and quarterly reporting periods.

Experience and the reality of running a successful business prove to us that managing our finances can be a daunting challenge. In many companies, the question “What did our customer pay us for?”, is asked every day. As a result, accounting departments spend a lot of time billing and processing payments. This often involves direct communication with clients – thousands of emails and hundreds of hours on the phone. Even when clients specify what their payment is for, it is often necessary to manually clear their invoices in the financial/accounting system.

All this requires a valuable resource – employee time – time that can be saved. This is precisely why Settlink was developed!

Save with Settlink

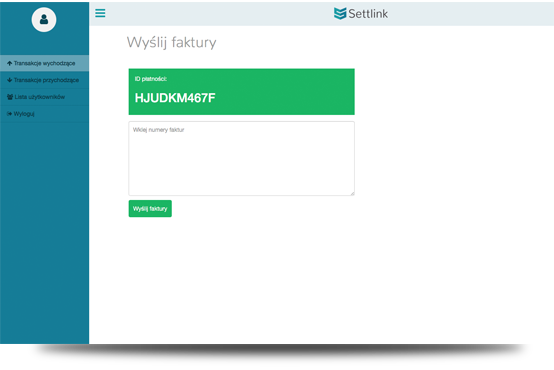

- Do you make a single payment for multiple invoices that pertain to a particular contractor?

- Do your suppliers continually ask for explanations upon receiving payments?

- Do you or your employees spend too much time processing incoming payments for multiple invoices?

If you answered “yes” to any of these questions, then Settlink is for you.

Our service is designed for businesses that regularly conduct transfers for many invoices or receive those types of transfers.